How to Avoid Fallout in Commercial Real Estate Loans

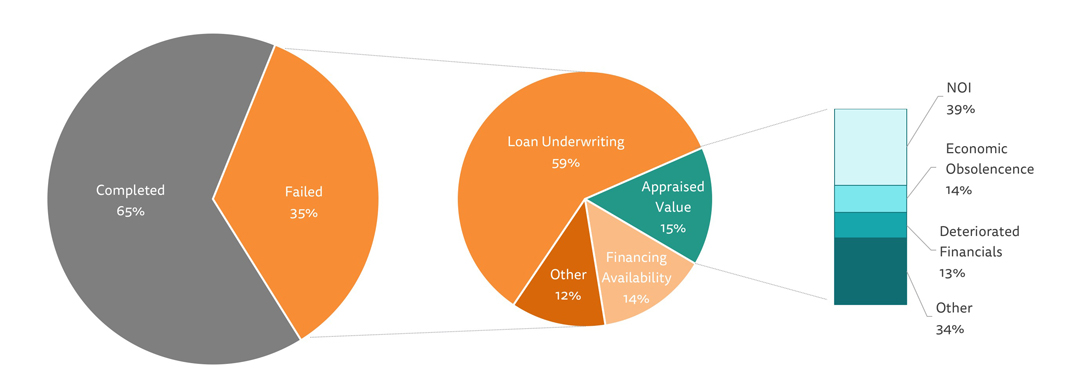

First the good news. Sixty-five (65) percent of commercial real estate loans are approved. That’s the good news.

Unfortunately, the bad news for commercial real estate investors and brokers is, of course, that 35-percent of commercial real estate loans get rejected for various reasons.

So, what are the most common reasons why commercial real estate loans fail? A 2017 survey conducted by the National Association of REALTORS among a random sample of realtors with an interest in commercial real estate loans found that:

So, what are the most common reasons why commercial real estate loans fail? A 2017 survey conducted by the National Association of REALTORS among a random sample of realtors with an interest in commercial real estate loans found that:

- 59-percent of commercial real estate loans fall out during the loan underwriting process. Our experience shows this happens often because the close is contingent upon the borrower fulfilling specific conditions for approval (i.e., downpayment, documentation, etc.)

- Another 15-percent commercial real estate loans fallout because of the property’s appraised value. The primary reasons for this include insufficient net operating income (NOI), economic obsolescence (when the value of a property decreases due to external factors in the local area) or deteriorated financials (a sign that the borrower is experiencing some form of financial stress or trouble).

- Another 14-percent get rejected because financing isn’t available. For example, lenders may change the terms of the loan (i.e., a lower LTV), or withdraw it all together if the borrower’s financials or credit don’t prove out during the underwriting process.

- Other reasons account for 12-percent of the fallout rate for commercial real estate loans.

Of course, many of these factors aren’t unique to commercial real estate loans, except for business-related issues like NOI, economic obsolescence, and deteriorated financials.

How Net Operating Income Affects the Fallout of Small Balance Commercial Real Estate Loans

Residential investment and small balance commercial real estate investors include many self-employed investors and small business owners who often write off expenses against their income to lower their tax liability. While perfectly legal, this can affect a borrower’s ability to qualify for investment and commercial real estate loans.

Although an investor may look cash poor, his or her investment in commercial property may indeed provide a long-term reward. A low net operating income is typical for residential investment properties that often generate lower rental incomes in the short term with a high amount of capital appreciation over time. So while the smart investor will try to limit their tax liability by writing off expenses, the practice may limit their access to the financing needed to acquire new properties. It’s not uncommon for small businesses to have similar low net operating incomes for the same reason.

Banks and wholesale lenders who offer mortgages backed by Government-Sponsored Enterprises like Fannie May or Freddie Mac must follow strict underwriting guidelines that make it difficult for W-2 employees, self-employed investors and small business owners to qualify for GSE-backed loans. Since 59-percent of failed loans occur during the underwriting process, such borrowers may find it easier to work with direct portfolio lenders who have the flexibility to “bend the rules” in their favor by offering a lower LTV to compensate for a lower net operating income.

How to Avoid Fallout from Financial Issues

Brokers who offer commercial real estate loans don’t want to waste their time and alienate clients by making promises they can’t keep. Avoiding this requires them to ascertain the probability of closing commercial real estate loans before they invest their time in submitting the loan for underwriting.

Some commercial brokers have a knack for reviewing business financial statements and spotting trouble. Less experienced brokers often turn to their financing partner for a quick assessment of the probability to close. A smart partner who understands the pitfalls related to closing small balance commercial real estate loans should be able to ascertain the probability to close within a few minutes.

Contingency Planning for Commercial Real Estate Loans

Of course, experienced brokers will always have a contingency plan in place for funding their fallout. Options can include alternative non-bank lenders that enable the borrower to acquire the property through short-term financing with a longer-term strategy to help them refinance later with more favorable terms. Through this approach, brokers gain the reputation as trusted advisors who help their clients overcome business challenges through the creative use of real estate financing solutions.

Indeed, having a secondary source of funding for the 35-percent of commercial real estate loans that fail is a good business strategy for brokers, particularly if that lender can provide the flexibility to meet the unique needs of their clients. After all, brokers are responsible for finding the “right loan” for each borrower, even if the solution involves an untraditional path.

Additional Resources